How to Conduct a Solar Walkthrough

Conducting a Solar Walkthrough with a Homeowner

This is information to be shared with a new homeowner regarding their solar system. This page will be modified over time based on user feedback and additional experience.

List of Topics to Discuss with Homeowner:

General description of the component parts of the solar system and how it operates

Share sample energy bill from another Habitat solar homeowner

Explain seasonality of solar production and variability of electricity bills

Explain what the homeowner can expect if they are careful with their energy usage (a small electric bill)

Explain the various components of an electric bill: usage, fuel cost adjustment, taxes, minimum billUS Department of Energy data shows that low-income households spend an average of 8.6% of their total household income on energy bills while non-low income households spend 2%.

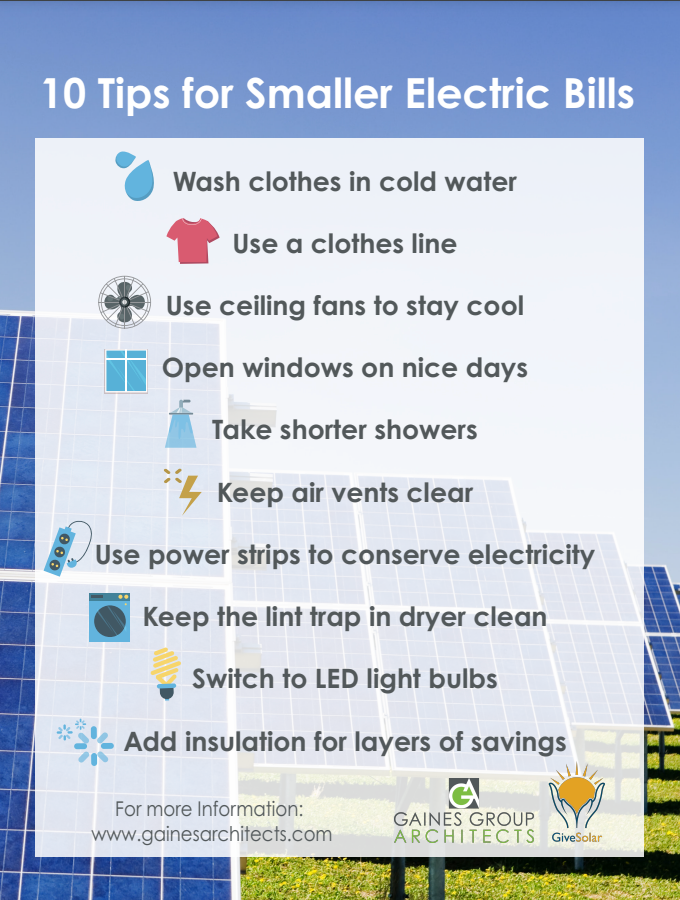

Minimize your electricity bill handout (refrigerator magnet)

If possible, provide the homeowner with a watt meter that can be used to determine the electricity usage of any appliance that is plugged into an outlet.

Warrantees–solar panels, inverters, and installation (provided by solar installer)

Interconnection agreement (Sometimes, the interconnection agreement has not been completed by the date of the walk through)

Solar Fact sheet – What to expect from your solar system

Solar Renewable Energy Credits****

Solar Investment Tax Credit – In some cases, Habitat homeowners may qualify for the Investment Tax Credit. This tax credit, if applicable, can reduce the amount of federal income taxes owed by 30% of the cost of the solar system (assuming that the homeowner incurred the cost of the solar system AND they owe federal income taxes). As an example, if the homeowner paid $10,000 for their solar system, then they are eligible to claim a $3000 tax credit on their federal income tax return. This credit can be claimed over five years.

During the Solar Walk Through, Verify:

Homeowners insurance policy (policy declarations page)

Signed interconnection agreement with electric utility

Turn on solar breaker to make sure the solar system in operating